Copyright © 2021 Dianne L. Durante. This is a research paper on the nature of cryptocurrencies, written by a historian for informational purposes. It is not investment advice! You may circulate this paper as long as the author and copyright information are kept intact. Email the author: DuranteDianne@gmail.com

Scope

I’m a historian: I don’t do new. I’m also retired and living on a fixed income, so I don’t gamble. Since I’m only interested in what cryptocurrencies can do for me, my questions going into this research project were:

- How does cryptocurrency work?

- Do cryptocurrencies qualify as money, rather than just flash-in-the-pan tech?

- If they are money, are they a better place for my savings than a conventional bank?

- Are cryptocurrencies good as an investment?

I’m not a tech geek, an economist, or a finance whiz, so I defaulted to my preferred method: getting a historical overview. This essay includes: the problems solved by money and by banks; problems solved by cryptocurrencies; how Bitcoin works (short and long versions); characteristics of cryptocurrencies and whether they are money; problems with using and investing in cryptocurrencies; and an appendix each on hashing and blockhashes.

1. What is money?

Money is a solution to a problem. In a barter economy, one good or service is traded for another. That’s complicated, because you need to know the relative values of shoes to cows, cows to carrots, carrots to haircuts. Money makes life easier by serving as a medium of exchange. Shoes, cows, carrots, and haircuts are all priced in terms of whatever you choose to use as money.

A variety of metals or commodities can serve as money – gold, silver, wampum, tobacco. A cow might be worth 10 ounces of gold, 30 ounces of silver, 50 pieces of wampum, or 30 pounds of tobacco.

Aside from the convenience of setting prices in money, money is a store of value. That’s why items chosen for use as money usually last a long time. If you make more money than you need to live on, you can put it aside for future purchases.

These are the usual requirements for items used as money:

- Fungible. Each unit should be of uniform size and quality, so the units are interchangeable. Lumps of gold of irregular sizes are not useful as money; gold coins of a standard size are.

- Durable. In the 18th century, tobacco was used as money in the British colonies in North America, because there were few coins in circulation. But tobacco eventually deteriorates, so it did not function as well as metal coinage.

- Portable. The item should be available in small denominations if needed, but when large quantities were required, it shouldn’t be too bulky. Shifting large quantities of tobacco-as-money was inconvenient. Shifting the same value in gold would (literally) be much less burdensome.

- Recognizable. The authenticity and quantity of the item should be easy to see. Diamonds are easily portable, but you need a jeweler’s loupe to check the authenticity and quality. A stamped piece of gold with milled edges doesn’t require such scrutiny.

- Stable. The commodity used for money should have a steady value, so that if you borrow a sum this year, the value will be the same (or nearly so) when you pay it back next year.

To make it easier from this point on, we’ll assume that the item chosen for use as money is gold.

2. What is a bank?

A bank is an answer to a problem raised by money. Suppose you earn more than you need to live, and want to save your money for the future. You could bury coins beneath your hearthstone … but a thief might steal them all, leaving you with nothing.

A bank originated as a place where you could deposit money for safe-keeping. The owners of the bank built a vault and paid for security to keep their depositors’ money safe. The bankers also took on the task of earning interest for you by lending out the money you deposit. That meant they vetted potential borrowers to make sure each borrower had enough collateral to ensure the loan amount could be recovered, if the borrower defaulted on payments.

Another function of banks: if you want to accept a check from someone instead of having him bring you cash, the bank will ensure that the check is sound – i.e., that he’s not giving you a useless slip of paper that’s not backed by his money in the bank.

The bank is a “trusted third party” that handles your money. For these services – keeping your money safe, lending it out to earn you interest, vetting checks – the bank collects a small fee.

But banks have problems, too. Thieves can steal money in the bank. Today a hacker can break into the bank’s computer system and steal money without even waving a gun.

These are the problems that cryptocurrency was originally designed to address. It was designed specifically for use in transactions on the Net.

3. The earliest cryptocurrency: Bitcoin

Today there are thousands of cryptocurrencies, but in the beginning, there was only Bitcoin. It’s easier to understand the basics of cryptocurrencies by looking first only at Bitcoin. Other cryptocurrencies work in slightly different ways, but if you grasp Bitcoin, you’ll be able to sort out the rest.

3.1 Timeline

- 8/18/2008: Bitcoin.org was registered as a domain

- 10/31/2008: Satoshi Nakamoto published a white paper explaining the purpose of Bitcoin and how it would work: “Bitcoin: A Peer-to-Peer Electronic Cash System”

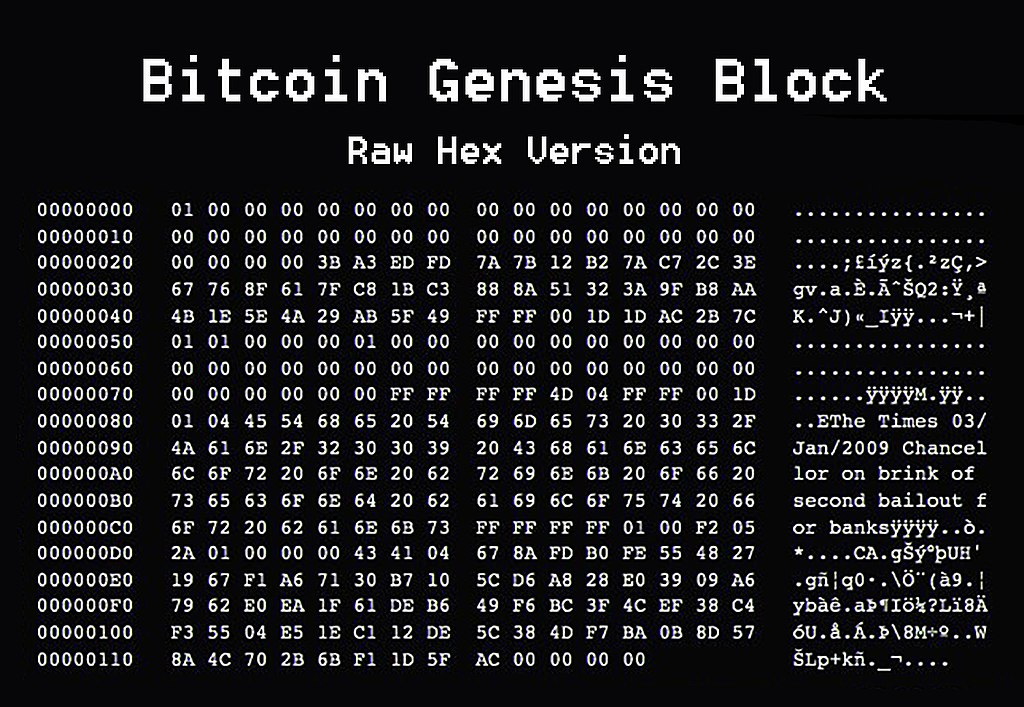

- Jan. 2009: the first Bitcoin block was released, a.k.a. the “genesis block”. It looks like this.

3.2 The mystery of Nakamoto

When the Bitcoin white paper was issued in 2008, Satoshi Nakamoto was active in a group called the Cryptography Mailing List. Nakamoto was no longer active after December 2010. Nakamoto has been variously identified (but never confirmed) as: a team of geeks, an Irish cryptographer, a California physicist, a Hungarian-American man, an Australian academic, a Finnish economic sociologist, a Japanese mathematician, an international drug dealer, and Elon Musk. (See Wikipedia.) The only practical effect of not knowing Nakamoto’s identity is that we can’t go ask him/her/they if he/she/they is/are happy about how cryptocurrencies have progressed. Bitcoin operates without the oversight or control of its founder.

In honor of Nakamoto, the units of each Bitcoin are called “satoshis”. One hundred million satoshis equals one Bitcoin.

3.3 The purpose of Bitcoin

We do know what Nakamoto wanted to achieve, because it’s stated in the white paper, “Bitcoin: A Peer-to-Peer Electronic Cash System.” The paper says: “I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party.” As stated by Nakamoto, these are the properties of the system:

- Double-spending is prevented with a peer-to-peer network.

- No mint or other trusted parties.

- Participants can be anonymous.

- New coins are made from Hashcash style proof-of-work. [Hashcash was a method devised in the late 1990s for limiting email spam.]

- The proof-of-work for new coin generation also powers the network to prevent double-spending.

The bottom line: Nakamoto proposed a way to eliminate banks, to allow anonymity, and yet to prevent people from spending money they don’t have.

3.3 How Bitcoin works

3.3.1 The short version

Here’s a quick overview of how a Bitcoin transaction works. I’ll introduce the proper terminology in 3.3.2.

You open your online account and tell it to make a payment in Bitcoin to John Smith. The transaction is sent for review by online volunteers, who check the transaction against the balance in your account. Once your ability to pay is verified, the transaction is written in the online Bitcoin ledger, and John Smith gets his money.

3.3.2 The long version

This is a complicated process. The complication is part of what makes Bitcoin transactions secure. Take a deep breath and refill your coffee.

3.3.2.1 Set up a transaction

First step: you set up a “wallet”, the equivalent of an online bank account where you send and receive Bitcoins. The safest wallets are small pieces of hardware like this one for US$119, which remain offline (immune from hacking) until the moment you want to make a transaction.

Your wallet is anonymous: no need to provide a name, address, social security number, etc. You just have to set up two keys. Each key is almost 30 characters long, and therefore difficult to hack.

- The “public key” is used when people send you Bitcoin. It’s the equivalent of your email when you’re using PayPal, or your account + routing number when you’re using a bank.

- The “private key” is one only you know. It’s required to access your collection of Bitcoins, when you want to make a payment or cash out Bitcoins.

Once you have a wallet, you can buy Bitcoin online from a cryptocurrency exchanges such as Binance, Coinbase, etc.

After you have Bitcoin in your wallet, you can order a payment sent to anyone, anywhere in the world, as long as you’ve got that person’s public key. You type in your private key, the amount, and the public key of the recipient. Depending on how urgently you want to get the transaction done, you may also want to add a larger-than-average transaction fee in satoshi (1/100 millionth of a Bitcoin).

You will receive a transaction number, which allows you to see the status of the transaction at sites such as Blockchain Explorer. All Bitcoin transactions are available for public viewing, although the users’ names are not attached.

3.3.2.2 A miner handles your transaction

The goal of processing transactions is to create a proof of the chronological order that they were made in, so no one can spend the same money twice.

The information about your transaction is sent to volunteers worldwide with powerful computers. (You can see the active nodes on this map.) The volunteers are known as “miners”, and their computers are known as “nodes”. Each node has the entire record of Bitcoin transactions stored on it, in condensed form. The nodes do not make changes in any transactions. In one way, they are like old-fashioned paper ledgers: after an entry is made, it can’t be deleted. Unlike a paper ledger, however, the Bitcoin ledger entries are a shared database that is absolutely identical across hundreds of thousands of computers. There is no central computer. The term for this decentralized method of keeping records is “distributed ledger technology”. Distributed ledger technology is one of the security features of Bitcoin – there’s no single point for a hacker to attack.

Your transaction goes out to these nodes and then into the “Mempool”, or Memory Pool, where the miners are busily searching for items to process. [Pool, miners: mixed metaphor. Not my doing.]

Miners can pick and choose transactions to verify. They pick groups of transactions that add up to about 1MB. That could mean they work with one transaction, or thousands: depends on the amount of data involved in the transactions. If you added a transaction payment of a fair number of satoshis when you set up your Bitcoin payment to John Smith, it’s more likely that a miner will quickly pick your transaction out of the MemPool.

When a miner – let’s call him Miner A – picks your transaction to process, here’s what happens.

- Suppose Miner A chooses 4 transactions to process: his current “block” of transactions. For each transaction, he verifies that the public key (for the recipient) and the private key (for the sender) are valid. If a key is invalid, the transaction involved is rejected, and Miner A must put together a new block. After the keys are verified, Miner A checks that there is enough Bitcoin in each sender’s account to cover the respective transactions. The miner does this by checking the ledger of all Bitcoin transactions, ever, that is stored on his node. If Miner A finds you have enough Bitcoin to pay John Smith, your transaction is verified. But suppose you have only 10 Bitcoins in your account, and twenty minutes ago you made a confirmed transaction to Jane Doe for that amount. Your payment of 10 Bitcoins to John Smith will be rejected. “Double-spending” is one of the problems Satoshi Nakamato had to solve when he proposed an electronic payment system that did not involve trusted third parties (banks, credit card companies, etc.). Miner A repeats the verification of available funds for the other 3 transactions in the group.

- After the miner verifies your transaction and the other 3 transactions he chose for this block, he must tell the rest of the Bitcoin miners that he has done this work. The “proof of work” is finding a string of letters and numbers to use in the “block hash”, which will be the unique identifier of this particular block. This is the labor-intensive part of mining: finding the random number that fits certain requirements. (More on the block hash in the Appendix, where head-spinning information goes.)

After Miner A has verified a group of transactions and created the block hash for the block he’s working on, he adds the block to the “blockchain” on his node. The blockchain is an ever-growing line of verified transactions that stretches back to the “genesis block” of Bitcoin, which was created by Satoshi Nakamoto in January 2009. Then Miner A broadcasts the new block to all the other active nodes.

Usually the initial verification of your transaction to John Smith takes 10 minutes or so. But if there are a lot of transactions queued up, it can take two hours or more.

3.3.2.3 Other miners confirm the block and add it to their blockchains

When Miner A’s new block arrives at a node run by Miner B, Miner B’s node verifies that all the transactions in the new block are OK (valid public and private keys, adequate funds) and that the blockhash is legitimate. Confirming the blockhash takes much less time and computing power than it took Miner A to find the blockhash: Miner B just has to run the hash function on all the transactions in the block to verify that no error was made. If all is well, then Miner B will aim to build his next blocks on Miner A’s block, the one that has your transaction to John Smith in it. If Miner B rejects the block, it is not added to the blockchain on his node. His next attempt at adding a block will be based on the block before Miner A’s.

The other active miners also check the calculations in the new block. A transaction is considered safe and secure when 5 blocks have been built on it, i.e., when Miners C, D, E, F, and G have accepted it as a verified block and added to it. At 10 minutes per block, that would take about an hour. After six confirmations, there’s less than a .1% chance that anyone will reject Miner A’s block. But if, for example, you were waiting for the equivalent of US$1 million for your yacht, it’s advised that you wait for 60 “confirmations” (60 blocks added to the block with your payment) before watching the yacht sail away into the sunset.

Since a miner can leave and rejoin the network at will (say, for maintenance), when he returns, he accepts the longest blockchain as the one to work on. He won’t build on a block that others seem to be rejecting.

3.3.2.3 Mining expenses and income

Today it takes considerable electricity and very expensive computers ($8,000 or more) to “mine” transactions – to verify a block of transactions and produce a blockhash for it. To cover these costs, miners are rewarded not with a percentage of the transaction amount or a flat fee (like PayPal or banks), but with the transaction fees voluntarily paid by users (in satoshis) … and with a certain number of Bitcoins: the “block reward”.

When Bitcoin began in 2009, the reward for completing a block was 50 Bitcoin. If you were an early adopter of Bitcoin, you could have used your home computer to earn 50 BTC in 10 minutes or so. Had you saved those 50 Bitcoins, they’d be worth $1.6 million today.

But that was long ago. In accordance with Satoshi Nakamoto’s plan, the block reward was halved in 2013, to 25 Bitcoin. In 2018 the reward dropped to 12.5, and in May 2020, to 6.25. In 2024 it will drop to 3.125 Bitcoin. By 2041, no more block rewards will be offered. Miners will instead be paid solely via transaction fees from users. At that point no more Bitcoins will be issued. The number of Bitcoins will top out at 21 million. As of July 2021, nearly 19 million Bitcoins are in existence, almost 90% of the total that will ever be mined.

One of the security features of Bitcoin is that miners are paid in Bitcoin. If a miner performs work that is not accepted as part of the blockchain (submitting a block that’s not verified, or building off an unverified block), he will not be paid. He will have expended computer time and electricity without any reward. The higher the cost to mine Bitcoin, the more secure the network becomes.

One site estimates that if you’re working with a single computer – even a very sophisticated one – you might hit a blockhash once in 16 years. For that reason, most miners today are part of “mining pools”, large groups of miners who work together and split their rewards.

4. Other cryptocurrencies

Since Bitcoin began in early 2009, hundreds of other cryptocurrencies have appeared … and many have also disappeared. A few of the current favorites:

- Litecoin: established in 2011; boasts of processing time four times faster than Bitcoin.

- Ethereum: introduced in 2015. After Bitcoin, Ethereum has the largest market capitalization (number of coins in circulation times the value of a coin). Ethereum has more advanced blockchain technology than Bitcoin. It also allows apps to be incorporated into its blockchains (hard to imagine, but hey) and allows the creation and exchange of NFTs (non-fungible tokens), unique digital property in the form of art or other items. If you’re curious about NFTs, this hilarious article is worth reading.

- IOTA: uses “the Tangle” rather than blockchain technology. When a user wants to make a payment, he has to confirm two other transactions first. The network achieves consensus through a coordinator node, which means IOTA is not decentralized like Bitcoin and the other cryptocurrencies mentioned above. IOTA was designed as an Internet of Things Application, so that (for example) your self-driving car could pay for a fill-up.

At the moment (7/4/2021), cryptocurrency’s market capitalization worldwide hovers at about US$1.46 trillion. Of that, US$661 billion is Bitcoin. Ethereum is second, with a market cap of $269 billion. By the time you get to the hundredth cryptocurrency on the list (HUSD) the market cap is a mere $588 million. The final cryptocurrency listed, number 5,535 (DealDough Token) – and three thousand types of cryptocurrency listed before it – have market caps of US$0. Clearly there have been lots of failed efforts and lots of opportunities to lose your shirt in cryptocurrencies.

5. Characteristics of cryptocurrencies

According to Bitdegree, these are the characteristics of all cryptocurrencies:

- Digital – exists entirely online. No coins, no printed money

- Decentralized – no central server

- Peer-to-peer – transactions are made person to person, rather than via a trusted third party

- Pseudonymous – users are not required to give any personal information

- Trustless – see #3.

- Encrypted – all information is encoded so that no one can access it without the proper codes

- Global – not native to any one country; no exchange rates

6. Are cryptocurrencies money?

Back in §1, I listed five characteristics of money. Let’s see how cryptocurrencies measure up.

- Fungible: units are uniform and interchangeable. Check.

- Durable: check.

- Portable: it’s virtual, so check.

- Recognizable: check.

- Stable: not so much. Values of particular cryptocurrencies have varied very widely and very quickly. Of course, fiat money (printed by the government) can also vary widely in value; but changes tend to occur more slowly. It would take someone very, very well versed in tech as well as finance to make an intelligent guess about whether a particular cryptocurrency will succeed or fail, rise or fall – especially in the company’s early days.

7. Problems with using cryptocurrencies as money

- No appeal for fraud or theft. It would be difficult to hack enough nodes (hundreds of thousands of computers) to fake a cryptocurrency transaction. That’s an improvement over a bank with a central computer. However, if someone gets the public and private access keys to your account, they own it. They can transfer the cryptocurrency out of it or spend it, as they please. There is no one (no bank, no credit card company) to whom you can report the breach in hopes of limiting your loss. To me, that’s the biggest reason not to put much money into cryptocurrency. The risk of losing the key to your cryptocurrency is significant enough that Bitcoin recommends you keep most of your cryptocurrency in an “offline wallet”, a.k.a. “cold storage” – a secured piece of hardware not connected to a network.

- No “password recovery” function if you forget your access code. Should you forget your private key, your funds are permanently lost. If you throw away the hard drive with all your access codes, you can be out millions. It’s estimated that 3-4 million Bitcoins have been lost.

- Hacking of exchanges. By 2013 Mt. Gox, a cryptocurrency exchange, handled 70% of all Bitcoin transactions. It was later discovered that in 2011, hackers had changed the price of Bitcoin on Mt. Gox to 1 cent, and gained control of thousands of Bitcoin at that price. In 2014, using Mt. Gox’s private key, hackers stole 740,000 Bitcoin from Mt. Gox customers and 100,000 from the exchange itself. At the time, that was worth roughly $460 million. Mt. Gox went bankrupt. Its customers are still trying to get their Bitcoins back – recovery laws have not yet been written that deal with cryptocurrency theft. Lesson: if you allow an exchange to store your cryptocurrency, instead of storing it in an offline wallet, you are at the mercy of the exchanges security measures. More on Mt. Gox here.

- Charges are irreversible. Send a payment to the wrong public key, and it’s gone.

- Transactions can be slow. If you find a brick-and-mortar store that accepts Bitcoin, you may have to stand around for quite some time waiting for the currency to clear.

- Prices of cryptocurrencies are volatile. Most of us still think in terms of conversion to local currency. If you contract to perform a transaction in cryptocurrency a month or a year from now, you might be very unpleasantly surprised at what you eventually pay or receive, in terms of your local currency.

8. Problems with cryptocurrencies as investment

- You can lose millions of US dollars in the blink of an eye. In 2011, one Bitcoin was worth US$1. In December 2017, one Bitcoin was worth more than US$20,000. In January 2021, one Bitcoin was worth about $7,500. A cryptocurrency can also simply vanish. Unlike a brick-and-mortar company, there will not be any assets to sell off in a bankruptcy sale. Cryptocurrencies are not a safe, solid, blue-chip investment. You shouldn’t put more into them than you can afford to lose.

- Cryptocurrencies vary not only over time, but from one cryptocurrency exchange (Binance, Bitstamp, Coinbase, etc.) to another.

9. Conclusion

I had four questions going into this research project. Here are the answers.

- How does cryptocurrency work? Answer: See §3.3.2 and Appendixes 1 and 2. Complicated, but I understand most of it now.

- Do cryptocurrencies qualify as money, rather than just flash-in-the-pan tech? Answer: They’re money, except that they’re more volatile than gold or most fiat (government-printed) money.

- If they are money, are cryptocurrencies a safer place to save my money than a conventional bank? Answer: They’re risky, although perhaps the risk is acceptable for finite amounts of the top names, Bitcoin and Ethereum.

- Are cryptocurrencies good as an investment? Answer: Cryptocurrencies are very volatile, and unless I were willing to track them hour by hour, I wouldn’t want to invest. As with any investment, I’d only risk as much as I could afford to lose.

Appendix 1: Hashing

The security of Bitcoin depends on hashing, one of the basic tools of modern cryptography. Hashing is a mathematical function that converts a sequence of numbers and letters of any arbitrary length into an encrypted sequence of numbers and letters of a specific length. You can see sample computer code for hashing here.

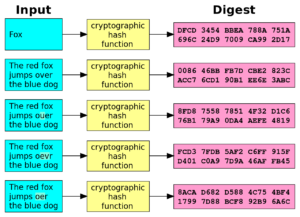

Hashing exactly the same data will always result in the same sequence of numbers and letters. Change one letter or digit, and the result will be completely different. Here’s a Wikipedia example:

Photo: Jorge Stolfi based on Helix84 / Wikipedia

The odds of hashing a different sequence of letters and numbers and getting the same hash are astronomical. And since hashing same sequence of numbers and letters will always give the same result, it’s easy to check the integrity of a block in a blockchain. Suppose I uploaded an altered version of Block 234 to one of the Bitcoin nodes. Within that block, I’ve changed my purchase of 1 Bitcoin into a purchase of 1,000 Bitcoin. Because 1 and 1,000 are different amounts, the hashed results for the block will be very different. The resulting hash will not agree with the results for Block 234 that are stored on the other hundreds of thousands of nodes in the system. Not only that, Blocks 235 and following will have different hash results, because the hash of Block 234 is incorporated into Block 235, leading to a different hash for Block 235, and Block 236, and so on. So all those other nodes are going to reject my revised Block 234.

To make a change that stuck, I’d have to make the same change across more than 50% of hundreds of thousands of nodes – an extremely labor- and resource-expensive task. That’s the reason that getting the correct blockhash is so time- and energy-intensive. (On hashing and the blockhash, see Appendix 2.)

No home, no institution, no computer system is completely thief-proof … but it’s possible to make theft so much work that the thieves will choose to move on to another victim. The difficulty of changing data that’s been hashed is a deterrent to anyone who wants to mess with the info on the blockchain.

Appendix 2: Blockhash

A blockheader or blockhash is the unique identification for each block in the Bitcoin blockchain. It’s a combination of the numbers 0-9 and the letters a-f. Here’s an example:

010000009500c43a25c624520b5100adf82cb9f9da72fd2447a496bc600b0000000000006cd862370395dedf1da2841ccda0fc489e3039de5f1ccddef0e834991a65600ea6c8cb4db3936a1ae3143991

A Bitcoin blockheader or blockhash links the current block inseparably to the previous block, and contains information about transactions that would be very difficult to separate out and alter. These are the elements:

- The version of the Bitcoin software in use when it was calculated.

- The blockheader of the previous block in the blockchain. Having this as part of the new block forms an unbreakable link between the blocks.

- The Merkle Root, which is a hash of all the hashes of the transactions in this block, arranged in a tree-like structure. If there are 4 transactions in a block, each of the 4 will be hashed separately. Then the first and second will be hashed together, and the third and fourth; then the 2 resulting hashes will be hashed into a final sequence. The Merkle Root’s hash is a one-line summary of all the transactions in the block. More on Merkle Roots and Merkle Trees here.

- A timestamp of the block, accurate within a fraction of a second.

- The difficulty target, a calculation that automatically changes depending on how quickly blocks are being confirmed: the Bitcoin software aims at 10-minute intervals. If, for example, all Chinese are forbidden from mining Bitcoin (which happened recently), there will be far fewer miners, and the difficulty target will be adjusted to make the blockhash faster to find, so that those miners can still complete a transaction every 10 minutes.

- The nonce, short for “number used only once”. You may have never heard the term, but when a company gives you a set of numbers and letters that can be used once and only once and dammit right now in order to reset your password … that’s a nonce. A miner focuses on generating, by trial and error, a random sequence of numbers and letters whose hash results in a sequence of letters and numbers that is less than or equal to the target hash set by the system. I can’t say I actually understand the target hash: if you’re curious, try here.

Because items 1-6 are all hashed multiple times, separately and then together, and because the hashing is one way (you can’t reverse-engineer to find out the original contents), the security of Bitcoin transactions is very strong.

The complex requirements for the blockhash make the odds of guessing it right 1 in 16 trillion. Hence Bitcoin miners use extremely sophisticated computers that spit out hash after hash after hash, to the tune of 10 petahashes (10 quadrillion hashes!!) per second. If Miner B gets an acceptable sequence before Miner A does, then Miner A has to start searching all over again for a blockhash, using the blockhash from Miner B’s block.

This page lets you see blocks that miners are currently working on. Click on one of the numbers at left, under “height” (its position in the blockchain), and you can get details of how much space the block requires, how many transactions it includes, how many Bitcoins it involves, how many nodes have confirmed it, and how long it’s been in progress.

More

- I am very good at researching and summarizing information from diverse fields … but writing this essay, and checking and rechecking it, took a lot of time and effort. If you found it useful, consider saying so with cold, hard cash via the blue “Leave a Tip” button on this page. Unfortunately, I don’t think the site accepts Bitcoins!

- See my About page for the topics I usually write about (cryptocurrencies are not it), the Books and Essays page for my recent publications, and my Amazon author page. To be added to my free mailing list, see this page.